India Allows 100% Foreign Ownership in Insurance | Parliament Approves Landmark Bill

India’s Parliament has approved a historic bill allowing 100% foreign ownership in the insurance sector, opening doors for global investment and potentially reshaping the industry landscape.

New Delhi — In a landmark move, India’s Parliament has approved legislation permitting 100% foreign direct investment (FDI) in the insurance sector, marking a significant reform in one of the country’s most closely regulated industries.

The bill, which was passed after extensive debate in both Lok Sabha and Rajya Sabha, replaces the existing cap of 74% foreign ownership and allows global insurance giants to fully own and operate insurance companies in India. Lawmakers highlighted that the reform aims to boost investment, increase competition, and provide consumers with wider choices.

Industry Impact

Insurance experts predict that the reform will redefine the Indian insurance market, attracting leading global insurers and capital inflows. Analysts note that the move may result in:

-

Increased product innovation, as foreign firms bring advanced insurance models and technologies.

-

Enhanced competition, leading to better coverage options and pricing for consumers.

-

Strengthened financial stability, as the influx of foreign capital may bolster the sector’s solvency and risk management capabilities.

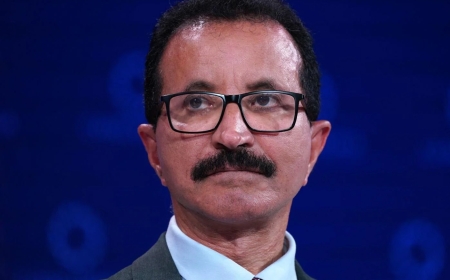

Sunil Mehta, CEO of a major private insurance company, commented, “This is a transformative moment for India’s insurance sector. Full FDI will encourage best practices, digital solutions, and partnerships that benefit policyholders and the industry alike.”

Parliamentary Debates

During the session, opposition members raised concerns about potential foreign dominance in the domestic market and the need for regulatory oversight to protect consumer interests. In response, the government assured that the Insurance Regulatory and Development Authority of India (IRDAI) would continue to closely monitor operations, ensuring transparency and compliance with Indian laws.

The legislation is expected to accelerate growth in both life and non-life insurance segments, expand coverage penetration across urban and rural areas, and contribute significantly to India’s financial sector development goals.

Global Investment Perspective

Foreign insurance companies have been waiting for regulatory clarity, and the approval of 100% FDI is expected to trigger a wave of new investments and partnerships. The reform aligns with India’s broader strategy to attract high-quality foreign capital, strengthen domestic markets, and integrate with global financial systems.

Industry analysts suggest that this move will position India as one of the world’s most attractive insurance markets, leveraging its growing middle class, rising awareness of insurance products, and expanding digital infrastructure.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0